Table of Content

A mortgage calculator can show you the impact of different rates on your monthly payment. We accept credit scores as low as 580 for conforming conventional loans. Higher credit scores, however will likely result in better loan terms.

Conforming loans are mortgages that adhere to maximum loan amounts determined by the government or other rules set by Fannie Mae or Freddie Mac. They are government-sponsored companies that agree to pay lenders if borrowers default on certain types of mortgages. Estimated monthly payment and APR calculation are based on a down payment of 25% and borrower-paid finance charges of 0.862% of the base loan amount. Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater.

Guide to Understanding Conforming Conventional Loans

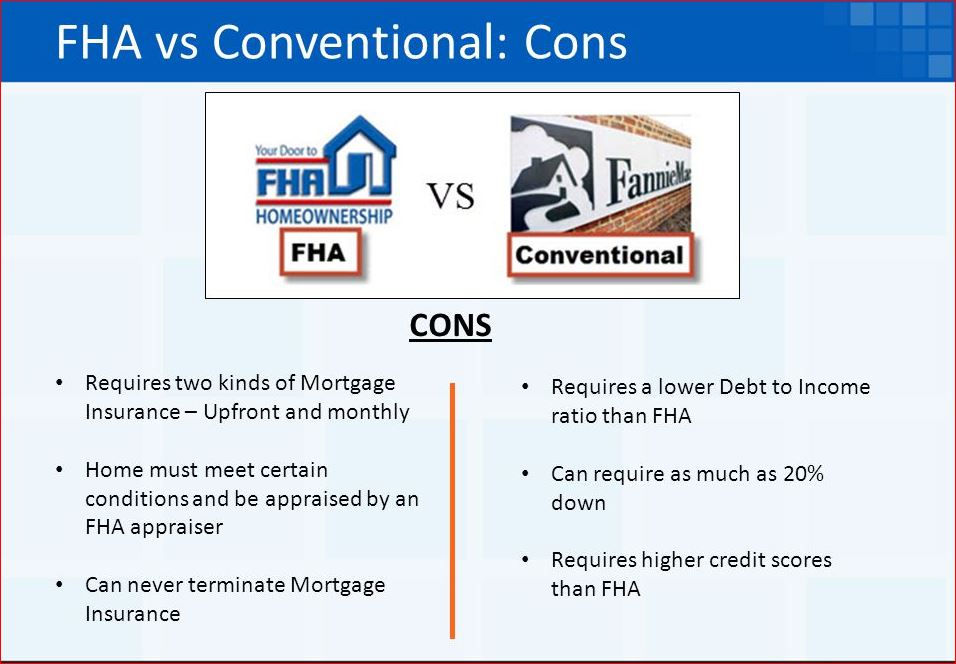

There are several types of conventional loans that you may come across as you compare lenders and mortgage options. With an FHA loan, you’re required to put at least 3.5% down and pay MIP as part of your monthly mortgage payment. The FHA uses money made from MIP to pay lenders if you default on your loan. The only way to get rid of MIP is if you have more than a 10% down payment—but even then, you’ll still have to pay it for 11 years! That means if you’ve borrowed $200,000, that’s an extra $200 on top of your regular mortgage payment each month. Because there are several different sets of guidelines that fall under the umbrella of “conventional loans,” there’s no single set of requirements for borrowers.

FHA loans are backed by the Federal Housing Administration, and VA loans are guaranteed by the Veterans Administration. Remember when you first started daydreaming about buying a home? You were probably imagining everything from freshly decorated rooms to a breathtakingly beautiful backyard.

Adjustable rates available

Paying an extra 1.75% may not sound like a lot, but for a $200,000 loan that's $3,500. You also can't waive the monthly insurance premium with an FHA loan without refinancing into a conventional loan. With a conventional loan, the private mortgage insurance is waived once you have a loan-to-value of 80% (i.e. 20% equity in the property).

When you’re thinking about your mortgage options, it’s important to understand the difference between conventional loans or mortgages and government-backed loans. Some conventional loan products allow the lender to pay for private mortgage insurance, but this is rare. Many of the exotic types of loans vanished after the mortgage meltdown of 2007, but conventional loans remained.

Interest Rates for Conventional Mortgages

To avoid paying mortgage insurance, you’ll need to put down 20%. VA loans, as indicated by the name, are special loans given to military veterans and active duty military members. This also includes staff serving in the National Guard and Reserves.

If your credit isn’t great, you might find it easier to qualify for an FHA loan. An FHA loan is often less expensive than a conventional mortgage if your credit scores are on the lower side or if you want to make a down payment of less than 10%. The 30-year conventional fixed-rate mortgage has long been popular due to its fixed interest rate and lower monthly payments. However, since the interest payments are spread out over 30 years, you'll pay more interest over the life of the loan than you would on a shorter-term mortgage. The alternative to the fixed-rate mortgage is the adjustable-rate mortgage loan, which features lower monthly principal and interest payments during the first few years. While many prefer the security of a fixed-rate loan, an ARM may be a better option - especially if you know you'll be moving within the next several years.

Whether it’s a fixed rate, ARM or jumbo mortgage, there are plenty of conventional mortgages to choose from as you embark on the mortgage process. One of the most popular mortgage structures is the conventional fixed rate loan. This type of financing establishes an interest rate that won’t change throughout the loan’s term. This guarantees a stable payment plan as you pay off the outstanding principal with the same payment from month to month.

Homes purchased through the FHA loan program must also meet stricterappraisal standardsto qualify for a mortgage. In that sense, a conventional loan can present fewer obstacles to buying. How much you can borrow matters when you're comparing conventional vs. FHA loans. FHA loan limits are determined based on where you plan to buy and the median home prices in that area. Conventional loans typically adhere to the same limit, regardless of the market you're buying in. For 2019, most buyers are subjected to a limit of $484,350 for a conventional loan.

Jared has a great skill of keeping things on track and moving the process forward. He's always secured the most competitive financing for each situation and goes above and beyond on each deal - I highly recommend Jared and Sharpe for any mortgage needs. Can be primary residence or second home, although second home interest rates are substantially higher.

Government-backed loan programs cannot be used to buy a second home or for investment properties. They are more focused on helping Americans to purchase homes that they use as their primary residence. Keep reading to learn more about the main types of conventional mortgage products, and what their differences might mean for you.

However, the type of the loan you take out is only one factor that impacts your decision to purchase a home or refinance your mortgage. Rising mortgage rates have increased the cost of borrowing for a home, and reduced how much buyers can afford. This has pushed some homebuyers out of the market and cooled the housing prices in some areas. But while the overall market remains this expensive, homebuyers should welcome every bit of help they can get. The FHA loan limit for low-cost areas is set at 65% of the conforming loan limit, and is higher in areas where homes are more expensive.

We accept down payments as low as 3% for conforming loans—or with no down payment at all, for buyers who qualify for our Zero Dollar Down Loan. You might find in your search for a loan that other types of loans are more beneficial for you. For example, first-time home buyers, borrowers with more debt, and those with more modest credit ratings may have trouble qualifying for a conventional mortgage. Others who may not qualify for a conventional mortgage include those who have filed for bankruptcy or don’t have cash reserves for a down payment.

Today, many buyers of homes often select a 5-year ARM or a 7-year ARM. Federal Housing Administration – The most lenient of mortgages, an FHA loan allows for credit scores as low as 500. They aim to assist lower-income homebuyers, offering affordable interest rates and down payments.

It’s also important to know how they differ from government-backed loans, so you can choose the right product to suit your needs. Buying a home is a major step and a big investment, so you want to get the mortgage that suits you best. Most adjustable-rate conventional mortgages have limits on how much the interest rate can increase over time.